Imagine buying a house at 35 (instead of 25) and paying off the mortgage at 65, just as you approach the last third of life, offering flexibility to help children, travel, make philanthropic gifts or return to school. Living with Mom and Dad could allow millennials to save for down payments on houses.

Opening tax-advantaged education accounts can help people return to school as they interweave work with education. Modest investments in savings vehicles, like Roth IRAs, which allow after-tax contributions to grow without ever being taxed again, can allow compound interest to work magic across many decades.

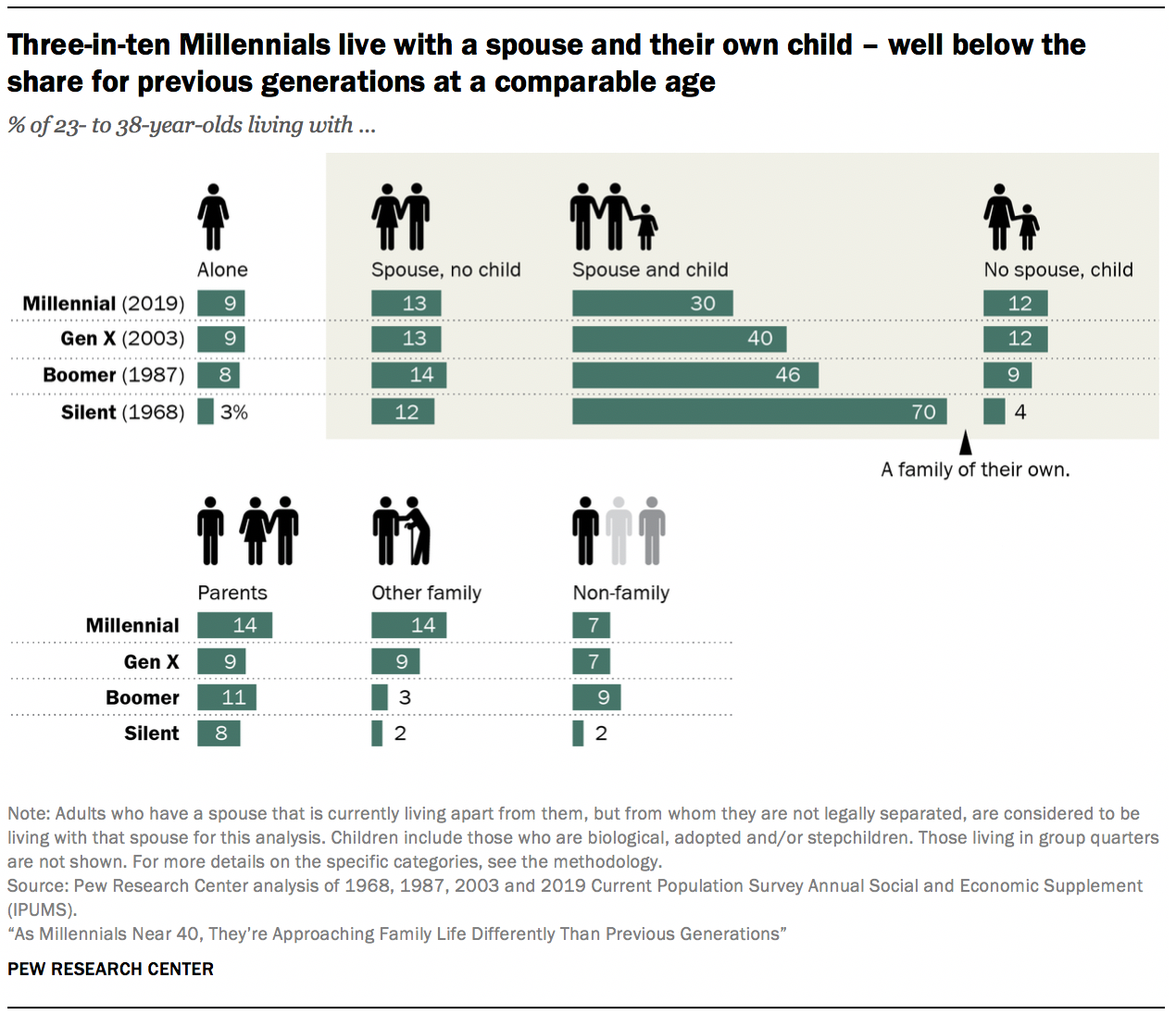

Being financially prepared not just for emergencies but for periods between jobs will be even more important than it is today. Under the best of circumstances, millennials are likely to change jobs several times. If living with parents longer allows young people to pay down debt and save for their futures, it would have great merit. If millennials face six decades of work instead of four, and lives that could stretch even longer, leaving home at 18 or even 22 may make little sense. It allows them to nurture multiple lifelong friendships when previous 20-somethings were busy looking for spouses. Viewed that way, living with parents isn’t a sign of failure but an adaptation to new family structures that include fewer siblings and cousins but more generations under the same roof. But these habits could be the right approach for a generation that could find itself working into its 70s or beyond and perhaps never retiring. Millennials are also less likely to be married or have children than were Gen X-ers or boomers at the same age. Many people have noted–and disparaged–the fact that so many millennials still live with their parents. If we unpack the larger set of findings about millennials, however, we can see the outlines of a new model that (with some key alterations) could make sense in this era of long life. More than a quarter of millennials report that they could not cover a $3,000 emergency, whether with their own savings or by borrowing from family or friends, and thus live day to day with the knowledge that one mistake or accident could lead to financial ruin. Both home ownership and participation in retirement savings accounts, the two avenues that Americans follow to secure their financial futures, are starkly down in a generation that needs to prepare for lives of unprecedented length. Millennial poverty is up, and employment is down, college debt is more than five times what it was just 20 years ago, and for those saddled with debt a more frightening financial picture emerges. Yet when we turn to financial security, there are alarming signs. More millennials have college degrees than do prior generations, and there is no better predictor of functioning well at advanced ages than education. More than young people in the past, millennials have friends they count on in tough times. Smoking rates are starkly down, and exercise is up. This way, we produce dynamic snapshots of changes early on that foreshadow the future population. We examine how six different age groups compare with people at the same age just 10 to 20 years ago. Sightlines focuses on metrics related to healthy lifestyles, social engagement and financial security, which predict long-term outcomes.

Are millennials living their lives differently from earlier generations? We undertook the Sightlines Project () at the Stanford Center on Longevity in order to address such questions. We’ve never had to ask what the 20s and 30s should look like when lives extend into the 90s and, for many, beyond 100 years.

0 kommentar(er)

0 kommentar(er)